The financial benefits of buying a home versus renting one are always up for debate. However, one element of the equation is often ignored – the ability to build wealth as a homeowner.

According to the latest research from the National Association of Realtors (NAR):

“Homeownership is a key pathway to building wealth and narrowing the racial income and wealth inequality gap. Housing wealth (equity) accumulation takes time and is built up by price appreciation and paying off the mortgage.”

An increase in equity builds the wealth of the individual that owns it. This wealth can be passed down to future generations. The Federal Reserve in an addendum to their Survey of Consumer Finances explains:

“There are numerous ways families can transmit wealth and resources across generations. Families can directly transfer their wealth to the next generation in the form of a bequest. They can also provide the next generation with inter vivos transfers (gifts), for example, providing down payment support to enable a home purchase or a substantial wedding gift.”

The Federal Reserve also explains another way wealth (including the additional net worth generated by an increase in home equity) can benefit future generations:

“In addition to direct transfers or gifts, families can make investments in their children that indirectly increase their wealth. For example, families can invest in their children’s educational success by paying for college or private schools, which can in turn increase their children’s ability to accumulate wealth.”

Here’s a look at how equity can build your wealth over time when you own a home.

Equity over the Last 30 Years

The NAR research reveals that the average gain for homeowners over the last five years was $139,134 and over the last 10 years was $218,505. Looking even further back in time, the article says:

“Homeowners who purchased a typical single-family existing-home 30 years ago at the median sales price of $103,333 with a 10% down payment loan and who sold the property at the median sales price of $357,700 in 2021 Q2 accumulated housing wealth of $349,258.”

Homeownership builds household wealth which also enables households to more easily move to the home of their dreams. As Mark Fleming, the Chief Economist at First American, explains:

“As homeowners gain equity in their homes, they are more likely to consider using that equity to purchase a larger or more attractive home – the wealth effect of rising equity.”

If you missed out on the equity gains over the last 30 years, don’t fret. Experts are still calling for substantial growth in equity over the next five years.

Looking Forward at the Equity To Come

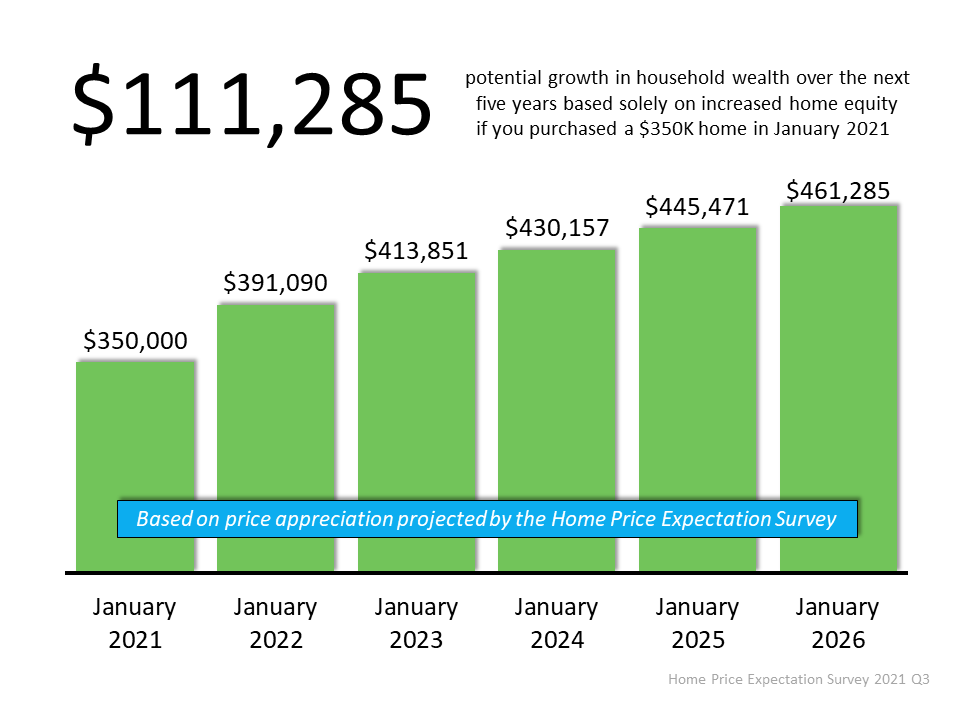

The most recent Home Price Expectation Survey, a survey of over one hundred economists, real estate experts, and investment and market strategists, expects home values (and therefore equity) to increase as follows:

- 2021: 11.74%

- 2022: 5.82%

- 2023: 3.94%

- 2024: 3.56%

- 2025: 3.55%

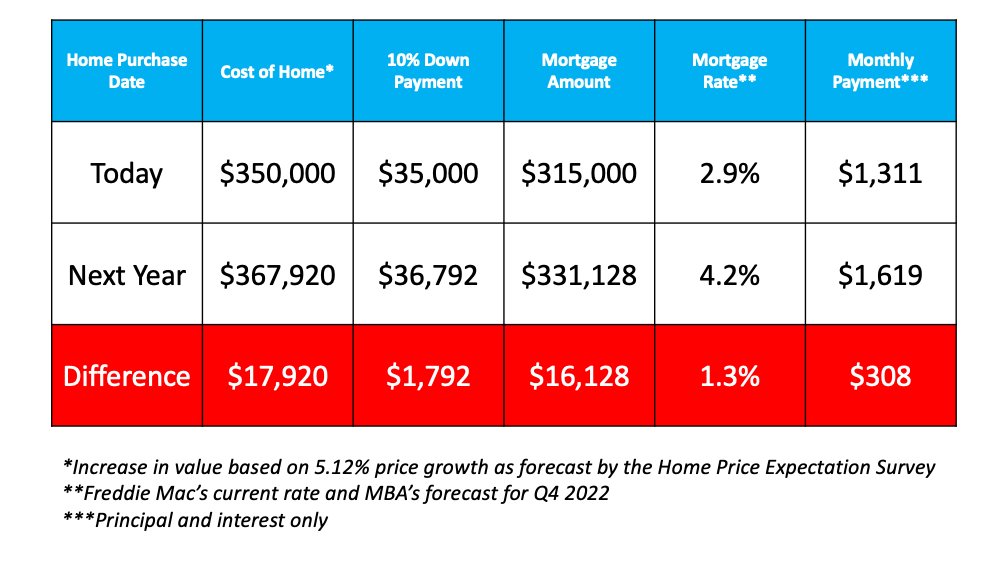

The survey estimates a 31.8% cumulative appreciation over the next five years. Using their annual projections, the graph below shows the equity build-up a purchaser could earn, using a $350,000 home as an example: That’s a potential increase in household wealth of $111,285 over five years.

That’s a potential increase in household wealth of $111,285 over five years.

Bottom Line

Owning a home is one of the best ways to grow your wealth over time. House wealth can impact generations. In many cases, the largest single investment a household has is their home. As that investment appreciates in value, the financial options also increase. Call me today to buy your first home in Portland, OR!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link