Now that the end of 2022 is within sight, everyone is asking what’s going to happen in the housing market next year and what that may mean if they’re thinking about buying a home. Here’s a look at the latest expert insights on both mortgage rates and home prices so you can make your best move possible.

Mortgage Rates Will Continue To Respond to Inflation

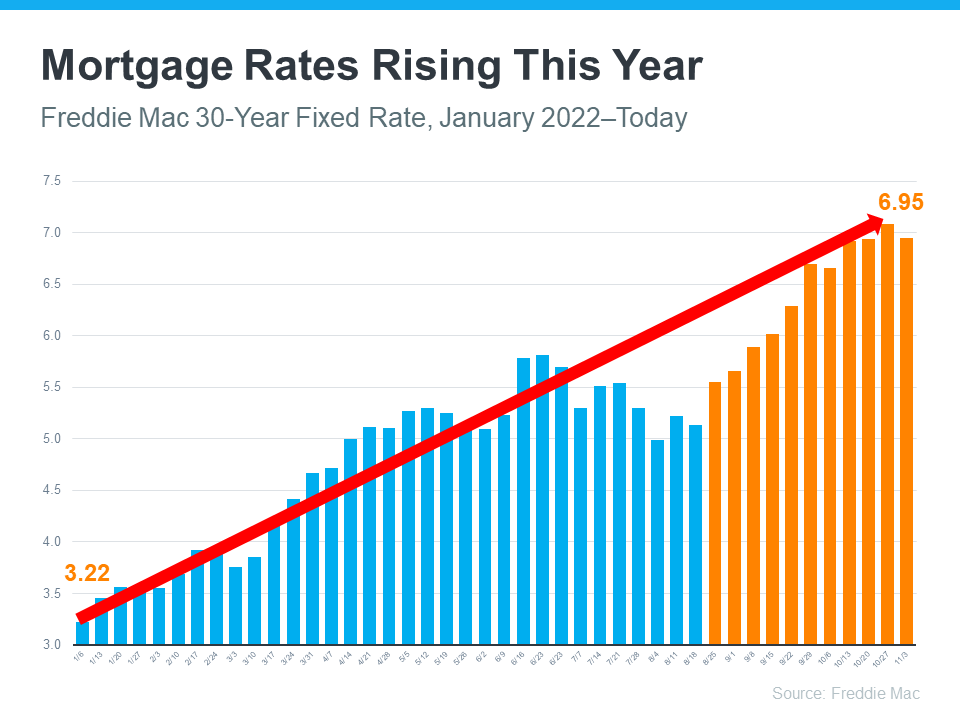

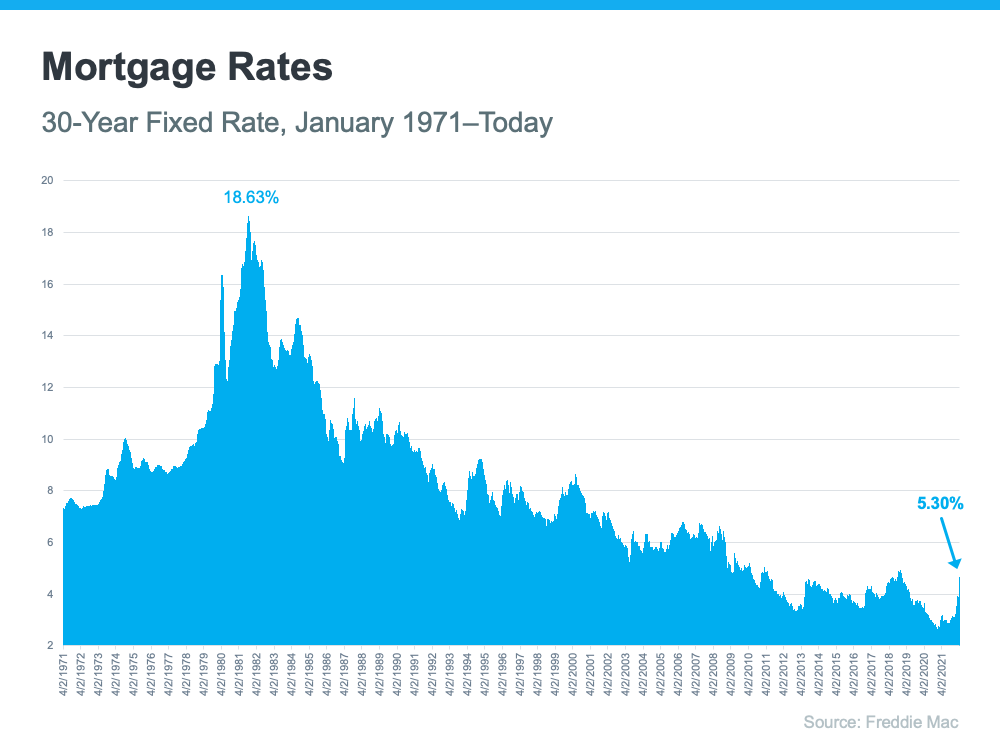

There’s no doubt mortgage rates have skyrocketed this year as the market responded to high inflation. The increases we’ve seen were fast and dramatic, and the average 30-year fixed mortgage rate even surpassed 7% at the end of last month. In fact, it’s the first time they’ve risen this high in over 20 years (see graph below):

In their latest quarterly report, Freddie Mac explains just how fast the climb in rates has been:

“Just one year ago, rates were under 3%. This means that while mortgage rates are not as high as they were in the 80’s, they have more than doubled in the past year. Mortgage rates have never doubled in a year before.”

Because we’re in unprecedented territory, it’s hard to say with certainty where mortgage rates will go from here. Projecting the future of mortgage rates is far from an exact science, but experts do agree that, moving forward, mortgage rates will continue to respond to inflation. If inflation stays high, mortgage rates likely will too.

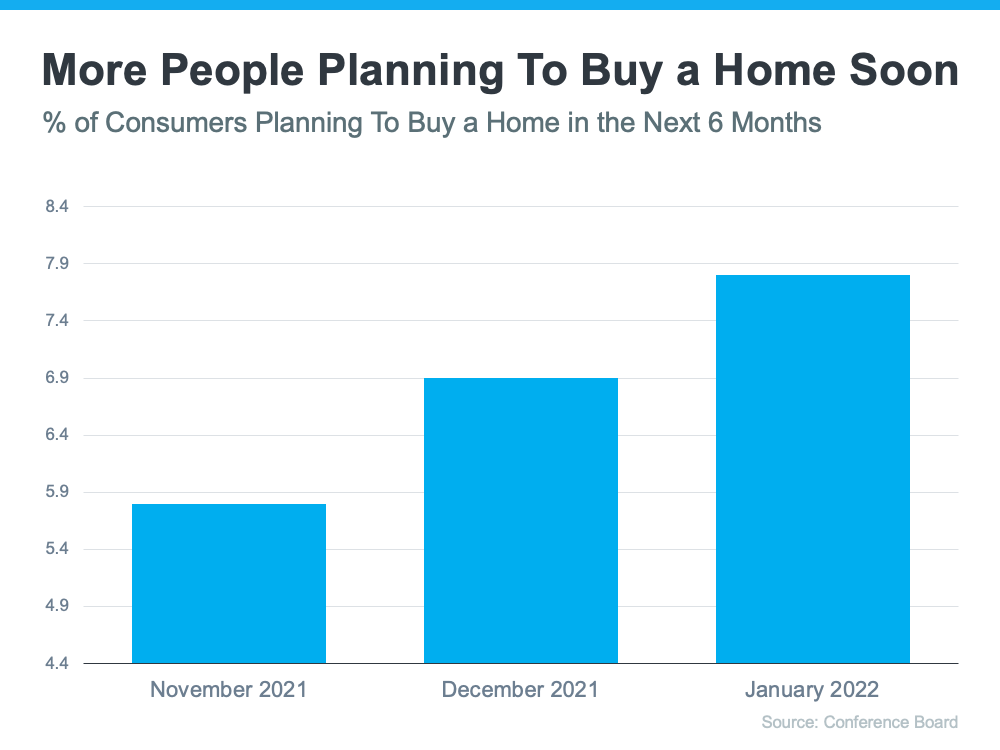

Home Price Changes Will Vary by Market

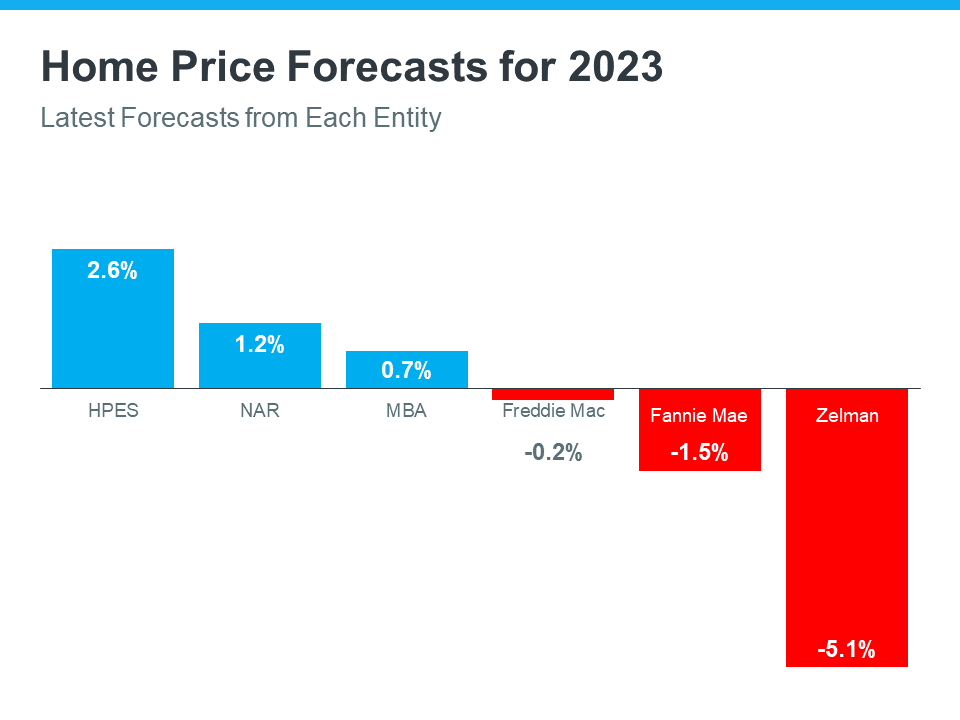

As buyer demand has eased this year in response to those higher mortgage rates, home prices have moderated in many markets too. In terms of the forecast for next year, expert projections are mixed. The general consensus is home price appreciation will vary by local market, with more significant changes happening in overheated areas. As Mark Fleming, Chief Economist at First American, says:

“House price appreciation has slowed in all 50 markets we track, but the deceleration is generally more dramatic in areas that experienced the strongest peak appreciation rates.”

Basically, some areas may still see slight price growth while others may see slight price declines. It all depends on other factors at play in that local market, like the balance between supply and demand. This may be why experts are divided on their latest national forecasts (see graph below):

Bottom Line

If you want to know what’s happening with home prices or mortgage rates, let’s connect so you have the latest on what experts are saying and what that means for the Portland metro area.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link