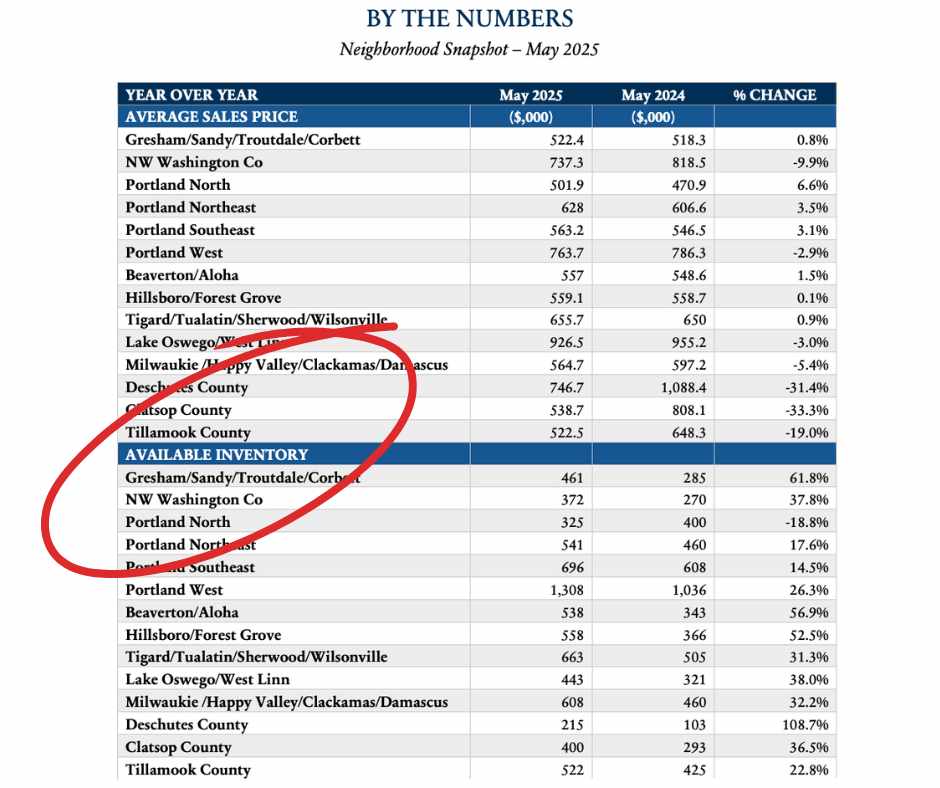

More than two weeks into the federal government shutdown, the U.S. housing market is showing clear signs of stagnation. Both buyers and sellers appear hesitant to make moves amid ongoing uncertainty in Washington, D.C., and this slowdown is expected to persist until the political impasse is resolved.

For the week ending October 11, national real estate activity—both listings and sales—remained muted, according to Realtor.com’s latest housing trends report. Homes are staying on the market longer than they did a year ago, and prices have largely flattened, suggesting increased inventory and reduced competition.

Economists at Realtor.com anticipate that overall housing activity will remain sluggish until lawmakers reach an agreement to reopen the government. Areas dependent on the now-suspended National Flood Insurance Program, which is necessary for many home transactions in flood zones, may experience a complete pause in closings.

Despite the overall cooling trend, some regions are holding steady. Select markets in the Midwest and Northeast—where demand is high but supply remains tight—continue to favor sellers, with buyers still facing competitive conditions.

New Listings and Pricing Trends

New listings last week were up 4.6% compared to the same period in 2024, showing only a modest increase. Data from the September Monthly Housing Report revealed a 1.2% annual decline in newly listed properties, highlighting ongoing hesitation among homeowners to put their houses up for sale.

Inventory levels continue to rise, up 15.1% from a year ago, marking the 100th consecutive week of annual gains. With 1.1 million active listings nationwide, the market has seen more homes accumulating rather than turning over quickly. The typical property now remains on the market for about 63 days—four days longer than last year—returning to pre-pandemic norms.

The slow pace of sales has led many sellers to reduce asking prices in hopes of securing offers before year’s end. Although the national median list price rose slightly, up 0.4% from the previous year, the price per square foot dipped by 0.5%, marking the sixth consecutive week of decline.

This softening in price per square foot suggests that underlying home values are being pressured by weak sales activity, even as overall price levels appear stable.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link